Financial self-reliance It might have a good theory. But in actuality, anyone may be successful. And when I say anyone, I include people like myself who once had student loan debt of many thousand dollars. Whatever financial challenges you’re facing right now, there’s always a way to get things back on track. Trying out a budgeting tool can be your first move. Know best 8-Step Formula To Achieve Financial Freedom in 2023.

This post will discuss the value of financial freedom and offer some advice, some of which I can personally attest to.

Financial freedom: What is it?

The first step to financial freedom is taking charge of your finances. You consistently receive money, which enables you to live the life you want. You don’t worry about how you’ll pay off bills or unplanned spending. And you don’t need to worry about a tons of debt.

It’s about realizing that you require additional funds to pay off debt and, possibly, expanding your income through a side business; more on that in a moment. Planning your long-term financial status also entails actively conserving money for retirement or a rainy day.

10 Game-Changing Financial Freedom Tips

1. Recognize your current situation

You cannot become financially independent if you don’t know where you are beginning from. Knowing how much debt you have, how much money you need, and how much money you don’t have in savings might be depressing. But this is a noteworthy advancement.

Including your mortgage, credit card debt, school loans, auto loans, and any other loans you may have taken out, make a list of all of your debts. Include any money that you may have borrowed from friends or relatives in the past.

Take a big breath right now. And yet another Then total up all the figures.

What sum of debt do you owe?

If the sum is substantial, don’t be alarmed; I’ll cover several methods for paying it off later in this post. If the number is low, congrats! Please feel free to share your suggestions in the space below.

Then, consider all the money you have amassed in savings.

Make a list of all your savings, including your investments, retirement plans, corporate retirement matching programs, stocks, and savings accounts. The regular monthly payments you get, such as your salary or earnings from a side job, will then be added.

As we go over the following few financial independence suggestions, keep these figures in mind.

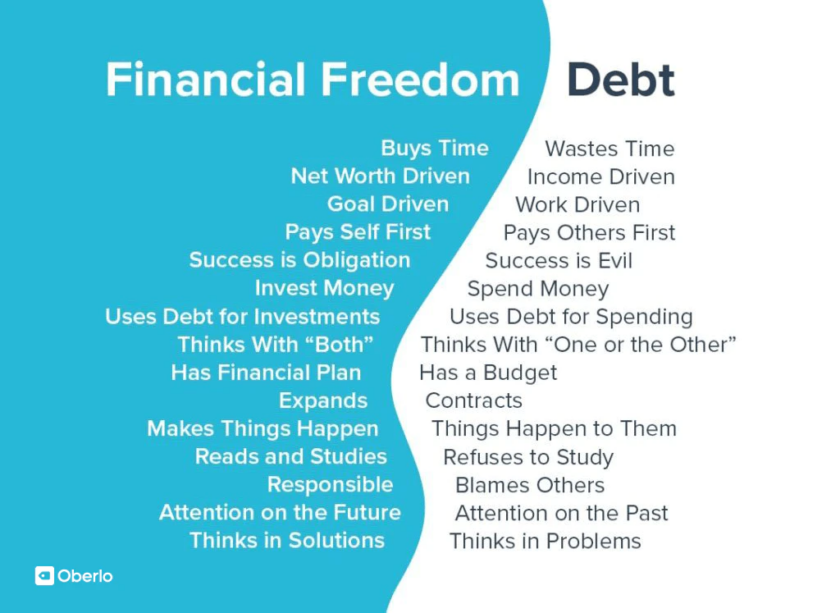

2. Take a positive view of money

Debt may undoubtedly be a little demoralizing.

However, keep in mind that money is a good thing, despite the fact that it currently appears to be burdensome.

You should be financially independent.

People who don’t make a lot of money frequently feel ashamed when it comes to making money, claims Jen Sincero in her book You Are a Badass at Making Money. The fact that many people believe having money is bad makes earning money the largest challenge they face. Many people feel guilty for both having it and wanting it. We use money every day to improve our lives, but we constantly seem to focus on the negative, according to Sincero.

Simple necessities like food and water include money. It enables you to purchase the things you require and lead the life you desire.

To attain financial freedom, you must view money as a tool that will enable you to pursue your goals, stoke your motivation, and lead a life free from stress.

Because if you have a negative attitude toward money, you’ll unwittingly hurt your chances of getting and maintaining it.

3. List your objectives

Why do you require cash?

Do you desire permanent debt relief? Do you long to leave the 9 to 5 grind? Is there a destination you’ve always yearned to visit? Do you need to put money down for retirement, a wedding, or children?

Because I linked financial freedom to an emotional objective, I was able to attain it. I wanted to pay off my student loans and start saving for a down payment on a house. And to be completely honest, it was a fantastic feeling to watch the debt go while my savings increased.

I worked harder to earn more money to see a bigger difference in my personal finances because I was so motivated by watching the numbers move. If I hadn’t connected my financial freedom with an emotional trigger, would I have succeeded in my goal? Most likely not. I was eager to leave my parents’ home and pay off my debt. Throughout my voyage, I remained inspired by that desperation.

Another intriguing event took place. On a scrap of paper in February 2016, I jotted down a couple of my objectives:

- Earn $100,000 through online product sales

- $20k in savings for the down payment

- pay off student loans totaling $24,000

That paper ended up getting lost, and I entirely forgot about it. After a little more than a year had passed and I had moved into my new house, I eventually discovered it in my notepad. And sure enough, I had finished all three. Funny thing was, I wasn’t even consciously considering those objectives.

Everything you wish to do might not get done in a month. However, a year is a long time to work toward your objectives. Make sure your objective is linked to a target number that you wish to achieve. Unbelievably, you’ll begin making progress toward those objectives without even recognizing it.

4. Monitor Your Expenses

Monitoring your spending is a crucial step on the path to financial freedom.

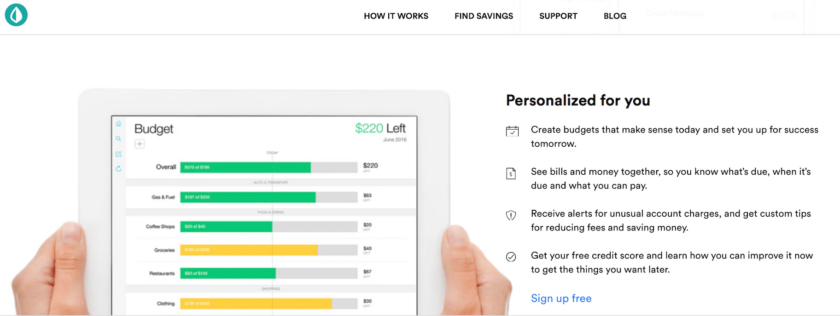

You can use a tool like Mint, which will inform you of your spending habits, the categories in which you’ve overspent, the total amount of money in each of your accounts, and your debt load.

Setting goals within the dashboard is another amazing feature of Mint. Depending on how much money you invest, you can keep track of your goals and determine the precise month you’ll be expected to reach them. As a result, it serves as a reminder to maintain saving money for it and to hold you accountable.

I was able to save some extra money after utilizing Mint for a month to contribute to my new wedding fund goal. Mint encouraged me to generate more passive income in order to reach my financial milestones and helped me keep focused on my goal.

5. Reimburse yourself first

Pay yourself first is a saying you’ve probably heard before. But in case you haven’t heard, “paying yourself first” refers to saving a certain amount of money before paying any other obligations, like bills. And paying yourself first has made it possible for countless people to go a little bit closer to financial freedom.

Why?

Because money left over must be used to pay bills after you pay yourself $1,000 each pay period. And if you don’t have enough money to pay those payments, you’re compelled to work a second job to cover the expenses.

Paying yourself first ensures that you are consistently setting aside funds to invest in yourself. By doing the opposite, you only receive what is leftover, which is frequently insufficient to grant you financial freedom.

There are other ways you can pay yourself first as well. If your employer offers a retirement savings plan, for instance, you might request to have money withheld for your retirement. By doing this, you put your future and self-investment first. Everything that is left over after the deductions from your income might be used to pay your bills and other costs.

6. Cut Costs

Warren Buffett paid $31,500 for a five-bedroom house in 1958, and he hasn’t left it since. Is he wealthy? incredible $90.3 billion. He is able to purchase a larger, more expensive home. But it’s possible that his thriftiness is what makes him one of the richest individuals in the world.

On the other hand, Kanye West isn’t ashamed to show off his wealth. He has a $20 million mansion as his home. And at one point, when he owed $53 million, he made the decision to tweet Mark Zuckerberg a $1 billion request.

What separates the two incredibly successful men? West spends money he doesn’t have while Buffet didn’t spend more than was necessary.

The truth is that a lot of wealthy people don’t appear wealthy. Every day, Zuckerberg essentially sports the same uninspired t-shirt and pants.

Less consumption can actually increase your wealth.

Spending less benefits you in two ways. One is that you’ll have more money to save for financial independence. The second is that you’ll come to realize that you truly require a lot fewer items to survive, which enables you to save more money.

This leads to our next point.

7. Buy Experiences, Not Thing

Life is brief. It is not necessary to save up all of your money until you are 65. You should take use of your life while you have it.

The experiences you have, not the stuff you own, are what will ultimately help you lead a more contented life.

And do the things you purchase ultimately make you happier? Does having debt from buying a lot of things make your life easier?

Let’s now turn the switch.

What is your most joyful memory? Who or what were you? With whom were you?

Let’s make more memories in the same way.

Perhaps you have a pal with whom you adore working out. Invite her over so she may exercise for free at your house to a YouTube playlist.

On a date tonight. You want to leave a lasting impression. On Groupon, you can find a fun activity you’ve never done before at a significant discount.

You’ve wanted to see Rome your entire life. You’ve been putting money down for a year so you can take the vacation of your dreams. Feel free to take that trip without feeling guilty. You earned it; you didn’t incur debt to obtain it. Alternately, you may work remotely while traveling the world as a digital nomad.

Moments are what make up a life. The best ones come from spending time with loved ones. While some goods, like weekly family video game nights, can help you become closer to your family, the majority of them don’t really add that much.

Spend no money. You are not required to act as though you are wealthy.

8. Repay Debt

Some experts would advise you that investing your money in equities is a better choice than clearing your debt. Maybe that’s true if you’re an exceptional stock picker. However, if you have never made an investment in stocks, you risk accruing extra debt.

After making their final debt payment, a lot of people experience the same feeling of relief.

Even if you have $30,000 in cash on hand in the bank, you can’t really consider yourself financially free if you owe $50,000 in debt. You’re still down by $20,000 right now.

Paying someone else moves you closer to financial freedom even though it’s not as glamorous as having money in the bank.

The two major approaches to debt repayment are avalanche and snowball. Paying off the smallest debt first is known as snowballing. When you pay off the debt with the highest interest rate, it is an avalanche.

You must choose what suits you the best. But I used the snowball effect while I was trying to get out of debt. It made me more motivated to keep going. I was able to pay off my first debt, a $1,200 credit card balance, in only one month, and the sense of success encouraged me to take on a much larger, lingering school loan.

And since using credit cards was no longer an issue, I would typically pay three times as much as the paltry $300 minimum. Instead of the nine years I was given, it ultimately took around three years to pay off the student loans.

An enormous burden is lifted off your shoulders when you pay off a large debt. You see an increase in your bank account balance after paying off your debt. Even if you had to see the number decline at first, it’s still an amazing sensation to see it rise, and it inspires you to keep increasing it.

Frequently Asked Questions

1. What formulas are used in finance?

- The most significant personal finance formulas

- Total Revenues – Total Costs = Net Income (Profit or Loss).

- Burn Rate is calculated as (Total Costs / Total Revenues)%.

- The formula 50-30-20.

- Rule of 72, Rule of 25 (or the 4% withdrawal rate), Net Worth (your equity), Rule of 25, and so on.

- Hours of life converted to money.

2. What is the secret of Napoleon Hill’s success?

Napoleon Hill’s Self-Confidence Formula equips you to: unlearn anxieties, insecurities, and limits picked up in childhood and adolescence, giving you the keys to success and fulfillment. Make up your mind that you will succeed without a doubt. take audacious, certain action toward your specific primary goal.