Financial stability can seem like an unreachable goal for many people. For context, consider that a startling 29% of Americans have no savings at all. Know everything about Financial Security.

But since the word “financial security” is a relative one, it is feasible for everyone to achieve it.

We cover all you need to know about financial stability and how to achieve it in this book.

Let’s start now.

What is Financial Security?

The mental calm we experience when we are not concerned about money is referred to as financial stability. This frequently entails being debt-free, making enough money to cover bills comfortably, and having emergency savings.

What Exactly Is Financial Security?

Some individuals think that in order to be financially comfortable, you need to be a billionaire or multimillionaire. But innumerable businesspeople, athletes, and movie stars have amassed enormous wealth only to lose it all.

The truth is that you don’t even need to have paid off your mortgage to be financially secure—you don’t even need a home, sports car, or private aircraft.

In the end, having financial security simply means that you have control over your money and aren’t concerned about covering expenses like rent or medical costs.

Nevertheless, what is meant by financial security varies from person to person. To help you define what this term means to you, we’ve listed four different sorts of financial stability.

1. Not having any debt

Feeling financially secure is difficult when you have a lot of debt.

Currently, some debt is necessary. For instance, very few people have the financial resources to pay in cash for a home or a higher education.

However, using credit to purchase necessities like clothing, electronics, or holidays is unlikely to help you reach financial security, particularly if the debt is on a credit card.

Bottom line: If you don’t repay the money you borrowed on time, you risk being sued, having your home foreclosed upon, and having your automobile repossessed. These potential outcomes are unlikely to provide you a sense of financial security.

On the other side, having no debt can contribute to feeling extremely secure financially.

2. Controlling Your Money

Is someone financially stable if they earn $100,000 a year but spend $110,000? Nope. This person is getting farther into debt and will find it difficult to make ends meet.

Therefore, learning to budget is a necessary first step if we want to learn how to become financially secure.

The method of budgeting allows you to keep your spending under control and avoid wondering where your money went. Being in charge of your finances greatly increases your likelihood of feeling secure financially.

Financial stability can be attained when you consistently have money left over at the end of each month.

Edmund Burke, an Irish statesman and philosopher, famously remarked that if we control our riches, we would be both wealthy and free. We are truly poor if our riches commands us.

3. Being ready in case of emergencies

Many people lack the resources to pay for health, homeowners, or renters insurance. Additionally, nearly 4 in 10 Americans (41%) said they would borrow money to handle a $1,000 emergency, according to a Bankrate survey.

Paycheck to paycheck living without adequate insurance or savings will inevitably have an impact on your sense of security.

You need appropriate insurance and a safety net in the bank for unforeseen events if you want to feel financially secure.

4. Improving Financial Security

There’s a good likelihood that your financial situation is worse if it isn’t improving.

Financial stability so implies reliable, consistent advancement. This can be making monthly mortgage payments, adding to a savings account, or making retirement investments.

You’re likely to feel more safe about your financial situation as you see your net worth and savings increases.

Financial Freedom vs. Financial Security

Financial freedom and financial security are two distinct emotions.

A financial security plan focuses on creating a sense of security through timely bill payment, increased savings, budgeting, investing, and insurance purchases.

Contrarily, having financial independence means having the freedom to live your life as you choose. What then is freedom, as the philosopher Marcus Tullius Cicero famously pondered? the freedom to live however one pleases.

This could entail early retirement, extensive travel, opulent purchases, or the freedom to leave a career you don’t like and discover something you do enjoy without worry for some.

Prior to achieving financial freedom, financial security must be attained.

The Value of Financial Safety

Why is having financial security crucial? Stress is a natural result of any kind of insecurity, whether it be professional, financial, or emotional.

Furthermore, it is obvious that happiness and financial stability are related. According to Dan Buettner, author of The Blue Zones of Happiness: Lessons From the World’s Happiest People, having financial security has several advantages. It reduces stress, worry, and anxiety while fostering emotions of security and comfort.

Creating Financial Security in 10 Easy Steps

The measures to achieving financial security are not difficult. They do, however, demand tenacity, diligence, and commitment.

Here are 10 suggestions to assist you understand how to obtain financial security if you want to conquer your finances.

1. Assess your circumstances

You must develop clarity before you can achieve financial security.

Take an inventory to get started. How much do you earn? How much do you have in investments and savings? What is the total amount of debt you have and what are the interest rates? Last but not least, how much do you spend each month?

Take notes on everything.

This can take some time to complete, so go slowly and, if necessary, divide the task into smaller ones. You may make changes to your financial condition after you have a thorough understanding of it.

2. Budget Your Money

Living within your means is a critical aspect of managing your financial stability. You always spend less than you earn, according to this.

Despite having a net worth of almost $78.9 billion, even the well-known billionaire Warren Buffett leads a humble life. Buffet still resides in the Omaha home he purchased for $31,500 in 1958.

This indicates that Buffet avoided the “lifestyle creep” trap, which is what happens when your income rises and your expenses follow suit, leaving you with little savings.

Make a budget, and always strive to live within your means.

3. Set financial objectives

Consider your financial objectives. What do you require to be financially secure? You might want to eliminate your credit card debt, create an emergency fund, or put aside some money each month for retirement.

Whatever it is, make a note of it. Determine how much money you will need to make each of your ambitions a reality.

Put your goals in priority order after you’ve established them all. Which are the most crucial? Why? Perhaps establishing an emergency fund or setting aside money for a down payment on a home are your top priorities. To make sure you are staying inside your budget, try utilizing a budgeting tool to monitor all incoming and outgoing cash.

4. Create a plan for financial security

The French author and pioneering aviator Antoine de Saint-Exupéry once observed, “A goal without a plan is just a hope.” Therefore, after listing all of your objectives, you must develop a plan for your financial security.

Look into the details more.

How long would it take you to save a $1,000 emergency fund, for instance, and how much money will you need to set aside each month? What would get in the way of you accomplishing this, and how can you avoid it?

5. Cut Back on Your Expenses

You’ll probably need to cut back on your spending once you’ve developed a financial security strategy in order to free up some cash.

Depending on how much money you need to save to achieve your goals, you might need to make sacrifices on both big and minor expenses.

Focus on long-term, steady successes when trying to save money. For instance, it’s fantastic to save $100 by buying a less expensive sofa, but you should also look for other methods to save $100 each month.

6. Pay Your Debt Off

Three out of four millennials in the U.S. are in debt, with an average load of $36,000, whether it be from credit cards or student loans.

There are two major strategies you might employ if you have debts that you want to pay off in order to reach financial security.

Regardless of interest rates, the snowball strategy recommends paying off your lowest-interest debt first, then working your way up to your highest-interest debt last. Dave Ramsey, a personal finance expert, said:

According to the avalanche technique, you should pay off the loan with the highest interest rate first before moving on to the debt with the lowest rate.

The least amount of interest can be paid overall using the avalanche method. The snowball approach, however, might give you a sense of empowerment that will enable you to pay off your debts more quickly.

7. Conserve money and then some more

Consistent saving is essential to obtaining financial security.

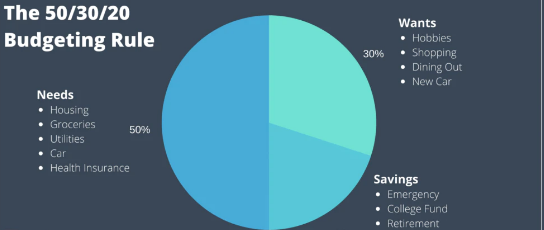

When it comes to saving, use Senator Elizabeth Warren’s 50/30/20 guideline if you’re unsure where to begin. Following is how the rule advises you to spend your money:

- 50% is spent on necessities like food, housing, and utilities.

- 40% is spent on wants like hobbies and shopping.

- 20% should go into savings, such as emergency and retirement accounts.

- Make an effort to start saving!

8. Make more cash

Finding strategies to make more money is another strategy to improve your financial stability. You may, for instance, ask for a raise in pay, hunt for a position paying more, or start a side business.

Starting a blog, becoming an affiliate marketer, and running a dropshipping business are all examples of common side hustles.

9. Invest in a Diversified Portfolio

Make sure you don’t put all your financial eggs in one basket if investing is a component of your plan for financial security.

Instead, diversify your investments with your money to build a portfolio. This will prevent you from losing all of your money in the event that an investment fails.

10. Be Reliable

Finally, keep in mind that managing financial security is a continuous process; consistency is key.

You must concentrate on forming sustainable habits if you want to achieve long-term financial security.

The businessman and motivational speaker Jim Rohn once said: “Success is neither mystical nor mysterious. Success follows naturally from continuously using fundamental principles.

How to Get Financial Security in Conclusion

- having no debt

- having control over one’s finances

- feeling ready to handle monetary emergencies

- progressively more financial security over time

- Keep in mind that being financially free is different from feeling financially secure; the latter refers to live without being constrained by money.

Here is a 10-step guide to assist you understand how to become financially secure:

- Consider your position.

- Living within your means

- Set financial objectives.

- Plan for your financial security.

- You should spend less.

- Clear your debt

- Save money for retirement and other goals.

- Look for strategies to boost your revenue.

- Spread out your investments to reduce risk.

- Be consistent in how you manage your financial security.

Listen to the businessman Henry Ford if you’re unsure if you can achieve financial security: You are correct, whether you believe you can or cannot.

Have we overlooked any important advice on monetary security? Please share your opinions in the section below.

Frequently Asked Questions

1. Why is having financial security important?

Thus, maintaining financial stability protects you from experiencing financial stress and mental illnesses. You can eat well and get medical treatment if you need it if you have money. Even those who are financially secure go through periods of stress, although for different reasons. Additionally, stress alone may not always result in mental disease.

2. By financial security, what do you mean?

The state of mind that results from your financial situation is called financial security. Financial stability is the mental calm and self-assurance that come from knowing your needs for the future and those of your family are being met. Why is monetary stability so crucial?

3. How does life quality differ depending on financial security?

Financial security affects people’s inner, emotional life in addition to how they feel about major institutions or policies. A 20 percentage point difference separates adults who are financially insecure from the general population since seven out of ten of them experience life anxiety.